PAY WITH YOUR HSA/FSA CARD

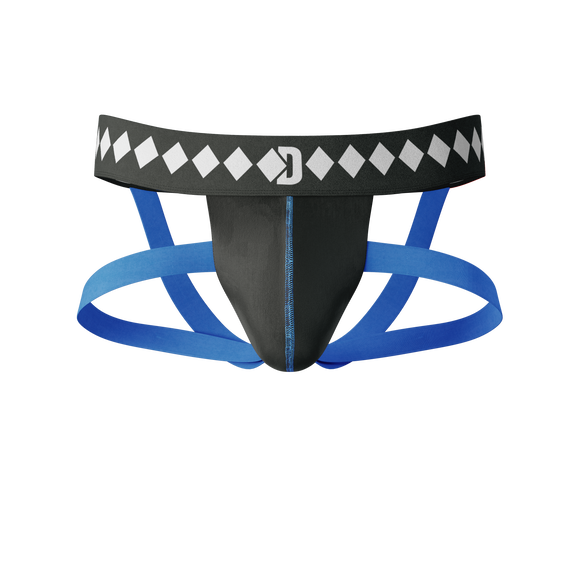

Diamond MMA has partnered with Flex to allow qualified customers to use their HSA or FSA. This means you may be able to use your HSA or FSA debit card to buy our products with pre-tax dollars.

Diamond MMA has partnered with Flex to allow qualified customers to use their HSA or FSA. This means you may be able to use your HSA or FSA debit card to buy our products with pre-tax dollars.

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select Flex | Pay with HSA/FSA as your payment option, confirm your eligibility, enter your HSA or FSA debit card, and complete your checkout as usual.

If you don’t have your HSA or FSA card handy, you can pay with a regular credit card and Flex will email you an itemized receipt to submit for reimbursement.

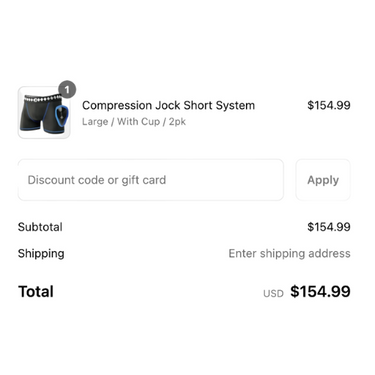

1. Add Products to Cart

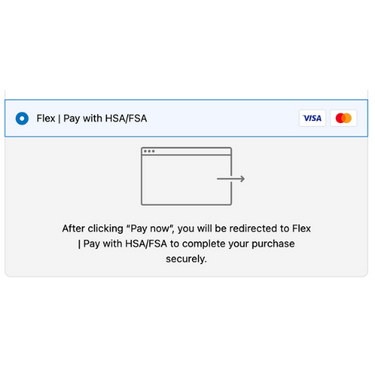

2. Select Flex at Checkout

Choose "Flex | Pay with HSA/FSA" under Payment

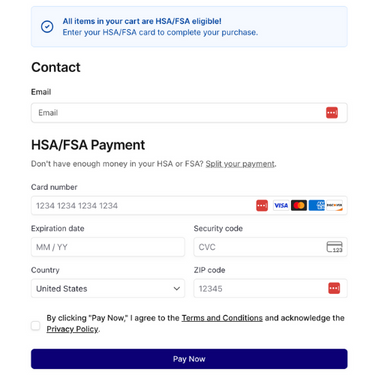

4. Enter your HSA/FSA card. Enter your HSA or FSA details

Flex is a trusted checkout partner that lets you pay with your Health Savings Account (HSA) or Flexible Spending Account (FSA) on DiamondMMA.com. Flex facilitates HSA/FSA payments, helps verify item eligibility at checkout, and emails an itemized receipt for your records. If you don’t have your HSA/FSA card handy, you can pay with a regular card and use the Flex itemized receipt to submit for reimbursement (based on your plan’s rules).

Diamond MMA’s relationship with Flex: We’re a merchant partner that integrates Flex into our checkout to enable HSA/FSA payments. We don’t approve claims, set eligibility rules, or access your HSA/FSA account details—those are managed by your benefits provider and/or Flex. Eligibility can vary by plan; some purchases may require a Letter of Medical Necessity (LMN).

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

If you were prompted to enter a verification code when logging in or at checkout, you’re likely using Shop Pay.

Shop Pay is Shopify’s express checkout option that lets you use your saved profile information across any Shopify-powered store. It speeds up the checkout process by skipping most of the standard steps.

Want to Use Your HSA/FSA with Flex?

If you’d prefer to check out using Flex to apply your HSA or FSA card, you’ll need to exit Shop Pay. Here’s how:

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance.

Please forward the request from your FSA to info@diamondmma.com, and Diamond MMA will work with the Flex team to issue you a new receipt.

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order.

No, unfortunately, this isn't a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

Sales tax for eligible items is also covered by HSA/FSA funds. If the customer has a split cart, the tax will be divided among the cards based on the items.